WASHINGTON — In a setback, House Republicans failed Friday to push their big package of tax breaks and spending cuts through the Budget Committee, as a handful of conservatives joined all Democrats in voting against it.

The hard-right lawmakers are insisting on steeper spending cuts to Medicaid and the Biden-era green energy tax breaks, among other changes, before they will give their support to President Donald Trump's budget bill. They warn the tax cuts alone would pile onto the nation's $36 trillion debt.

The failed vote, 16-21, for now stalls House Speaker Mike Johnson's push to have the package approved next week.

The Budget Committee plans to reconvene Sunday to try again. Lawmakers vowed to negotiate into the weekend as Trump returns to Washington from the Middle East.

Tallying a whopping 1,116 pages, the bill is teetering at a critical moment. Johnson, R-La., is determined to resolve the problems with the package that he believes will inject a dose of stability into into a wavering economy.

People are also reading…

With few votes to spare from his slim majority, the Republicans are trying to pass it over the staunch objections of Democrats, who slammed the package as a "big, bad bill," or as Rep. Pramila Jayapal, D-Wash., called it, "one big, beautiful betrayal."

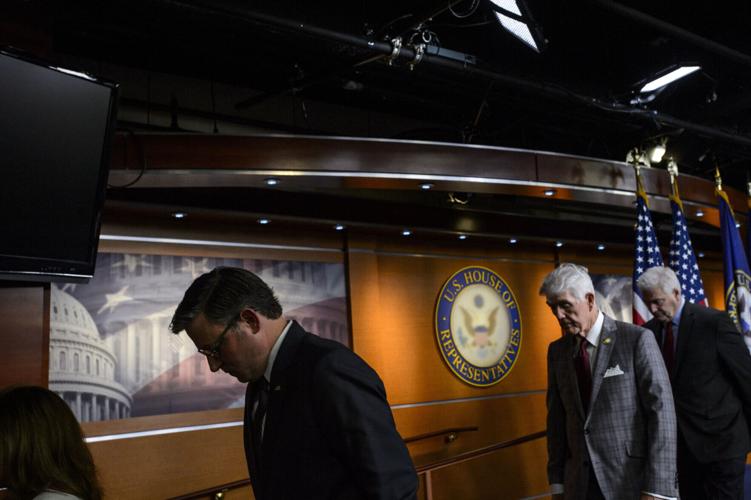

Speaker of the House Mike Johnson, R-La., left, House Small Business Committee Chairman Roger Williams, R-Texas, center, and House Majority Whip Tom Emmer, R-Minn., right, depart a news conference at the Capitol, May 6, in Washington.

Ahead of Friday's vote, Trump implored his party to fall in line.

"Republicans MUST UNITE behind, 'THE ONE, BIG BEAUTIFUL BILL!'" the Republican president posted on social media. "We don't need 'GRANDSTANDERS' in the Republican Party. STOP TALKING, AND GET IT DONE!"

"Something needs to change or you're not going to get my support," said Rep. Chip Roy, R-Texas.

The Budget panel is one of the final stops before the package is sent to the full House floor for a vote, which is still expected sometime next week. Typically, the job of the Budget Committee is more administrative as it compiles the work of 11 committees that drew up various parts of the big bill.

Friday's meeting proved momentous even before the votes were tallied.

The conservatives, many from the Freedom Caucus, warned they would block the bill, as they hold out for steeper cuts. At the same time, GOP lawmakers from high-tax states including New York are demanding a deeper tax deduction, known as SALT, for their constituents.

Speaker of the House Mike Johnson, R-La., speaks during a news conference at the Capitol, May 6, in Washington.

Four Republican conservatives initially voted against the package — Roy and Reps. Ralph Norman of South Carolina, Josh Brecheen of Oklahoma, Rep. Andrew Clyde of Georgia. Then one, Rep. Lloyd Smucker of Pennsylvania, switched his vote to no in a procedural step so it could be reconsidered later, saying afterward he was confident they'd "get this done."

Norman insisted he was not defying the president — "this isn't a 'grandstand,'" he said — as he and the others push from Trump's priorities.

In their quest for deeper reductions, the conservatives are particularly eyeing Medicaid, the health care program that covers about 70 million Americans. They want new work requirements for aid recipients to start immediately, rather than on Jan. 1, 2029, as the package proposes.

Democrats emphasized that millions of people would lose their health coverage and food stamps assistance if the bill passes, while the wealthiest Americans would reap enormous tax cuts. They also said it would increase future deficits.

"That is bad economics. It is unconscionable," said Rep. Brendan Boyle, the top Democratic lawmaker on the panel.

At the same time, talks are also underway with the New Yorkers have been unrelenting in their demand for a much larger SALT deduction than what is proposed in the bill, which could send the overall cost of the package skyrocketing.

As it stands, the bill proposes tripling what's currently a $10,000 cap on the state and local tax deduction, increasing it to $30,000 for joint filers with incomes up to $400,000 a year.

Rep. Nick LaLota, one of the New York lawmakers leading the SALT effort, said they proposed a deduction of $62,000 for single filers and $124,000 for joint filers.

The conservatives and the New Yorkers are at odds, each jockeying as Johnson labors to pass the package from the House by Memorial Day and send it onto the Senate.

Speaker of the House Mike Johnson, R-La., joined from left by House Majority Whip Tom Emmer, R-Minn., and House Majority Leader Steve Scalise, R-La., talks to reporters about his push for a House-Senate compromise budget resolution to advance President Donald Trump's agenda, even with opposition from hard-line conservative Republicans, at the Capitol in Washington, April 8, 2025.

Moody's lowers U.S. government's credit rating, citing rising debt

At its core, the sprawling package extends the existing income tax cuts that were approved during Trump's first term, in 2017, and adds new ones that the president campaigned on in 2024, including no taxes on tips, overtime pay and some auto loans.

It increases some tax breaks for middle-income earners, including a bolstered standard deduction of $32,000 for joint filers and a temporary $500 boost to the child tax credit, bringing it to $2,500.

It also provides an infusion of $350 billion for Trump's deportation agenda and to bolster the Pentagon.

Later in the day, Moody's Ratings stripped the U.S. government of its top credit rating, citing successive governments' failure to stop a rising tide of debt.

Moody's lowered the rating from a gold-standard Aaa to Aa1 but said the United States "retains exceptional credit strengths such as the size, resilience and dynamism of its economy and the role of the U.S. dollar as global reserve currency."

Moody's is the last of the three major rating agencies to lower the federal government's credit. Standard & Poor's downgraded federal debt in 2011 and Fitch Ratings followed in 2023.

In a statement, Moody's said: "We expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation.''

Extending Trump's 2017 tax cuts, Moody's said, would add $4 trillion over the next decade to the federal primary deficit (which does not include interest payments).

To offset more than $5 trillion in lost revenue, the legislation package proposes rolling back other tax breaks, namely the green energy tax credits approved as part of President Joe Biden's Inflation Reduction Act. Some conservatives want those to end immediately.

The package also seeks to cover the costs by slashing more than $1 trillion from health care and food assistance programs over the course of a decade, in part by imposing work requirements on able-bodied adults.

Certain Medicaid recipients would need to engage in 80 hours a month of work or other community options to receive health care. Older Americans receiving food aid through the Supplemental Nutrition Assistance Program, known as SNAP, would also see the program's current work requirement for able-bodied participants without dependents extended to include those ages 55-64. States would also be required to shoulder a greater share of the program's cost.

The nonpartisan Congressional Budget Office estimates at least 7.6 million fewer people with health insurance and about 3 million a month fewer SNAP recipients with the changes.

While Republicans insist the package will pay for itself, partly with economic growth, outside budget analysts are skeptical and say it will add trillions of dollars to the nation's deficits and debt.

___

This story has been corrected to show the package looks to offset $5 trillion, not $5 million, in lost revenue.

Associated Press writer Leah Askarinam contributed to this report.